Taxpayers with a filing requirement must file a tax return to get an Economic Impact Payment While most eligible taxpayers don’t need to take any action to receive an Economic Impact Payment, some people will. This includes those who are required to file and haven’t filed a tax return for either 2018

... Continue ReadingCORONAVIRUS EMERGENCY LOANS Small Business Guide and Checklist

The Coronavirus Aid, Relief, and Economic Security (CARES) Act allocated $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn. Known as the Paycheck Protection Program, the initiative provides 100% federally guaranteed loans to small businesses.

... Continue ReadingCoronavirus Aid, Relief, and Economic Security Act (CARES Act) Q&A:

Coronavirus stimulus check scams are out to swindle you: Do not give out your PayPal account information, Social Security number, bank account number or anything else if someone claims such information is essential to sign you up for a stimulus check relating to the coronavirus pandemic. It's not. It's a

... Continue ReadingIRS Provides More Clarity on Extended Filing and Payment Deadlines

From EISNERAmper LLP Recently, the IRS announced in Notice 2020-18 federal income tax return filing and payment relief in response to the coronavirus (COVID-19) emergency. Its release raised as many questions as it answered. On March 24, the IRS began the process of addressing those questions, through a

... Continue ReadingTAXPAYER SECURITY AWARENESS

TYPES OF SCAMS Receiving Threatening Phone CallsReceiving Unusual EmailsOffers to Collect Tax Payments in PersonRequest for a Specific Type of Payment (like a Gift Card) PROTECTING PRIVATE INFORMATION Physically Protect Your ComputerUse Strong Passwords and Change PeriodicallyUse a Secure

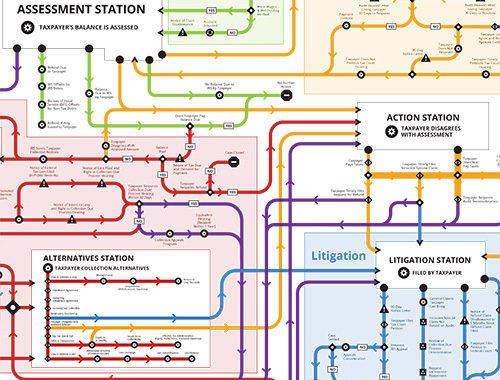

... Continue ReadingThe Taxpayer Roadmap 2019

The map below illustrates, at a very high level, the stages of a taxpayer’s journey, from getting answers to tax law questions, all the way through audits, appeals, collection, and litigation. It shows the complexity of tax administration, with its connections and overlaps and repetitions between stages.

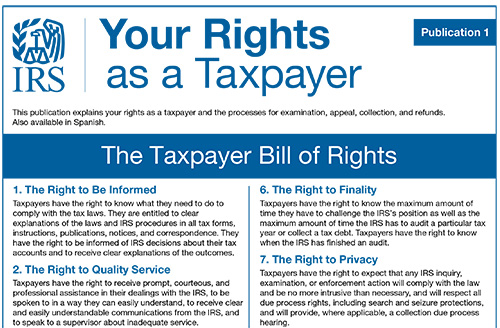

... Continue ReadingThe Taxpayer Bill of Rights

This publication explains your rights as a taxpayer and the processes for examination, appeal, collection, and refunds. Read the Taxpayer Bill of Rights

... Continue Reading2019 YEAR END TAX STRATEGIES

General Tax Planning Moves Higher income filers ($250,000 married filing joint; $125,000 single) may be subject to the additional 3.8% Net Investment Income Tax. This is based on the calculated amount of the Adjusted Gross Income. There is also the additional 0.9% Medicare tax on these high-income

... Continue Reading401(k) contribution limit increases to $19,500 for 2020; catch-up limit rises to $6,500

WASHINGTON — The Internal Revenue Service today announced that employees in 401(k) plans will be able to contribute up to $19,500 next year. The IRS announced this and other changes in Notice 2019-59 (PDF), posted today on IRS.gov. This guidance provides cost‑of‑living adjustments affecting dollar

... Continue Reading