On Wednesday, March 10, the House of Representatives, by a party-line vote of 220-211, passed the Senate's version of the American Rescue Plan Act (the Act) that had been narrowly approved on Saturday, by a 50-49 vote. The House accepted the Senate's version of the Act without change and President Biden

... Continue ReadingTreasury and IRS begin delivering second round of Economic Impact Payments to millions of Americans

WASHINGTON – Today, the Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the first round of payments earlier

... Continue ReadingTAXPAYER SECURITY AWARENESS

TYPES OF SCAMS Receiving Threatening Phone CallsReceiving Unusual EmailsOffers to Collect Tax Payments in PersonRequest for a Specific Type of Payment (like a Gift Card) PROTECTING PRIVATE INFORMATION Physically Protect Your ComputerUse Strong Passwords and Change PeriodicallyUse a Secure

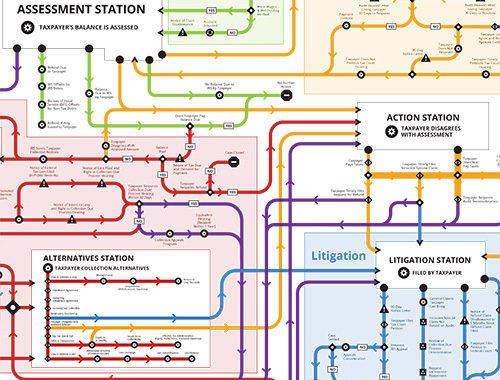

... Continue ReadingThe Taxpayer Roadmap 2019

The map below illustrates, at a very high level, the stages of a taxpayer’s journey, from getting answers to tax law questions, all the way through audits, appeals, collection, and litigation. It shows the complexity of tax administration, with its connections and overlaps and repetitions between stages.

... Continue ReadingThe Taxpayer Bill of Rights

This publication explains your rights as a taxpayer and the processes for examination, appeal, collection, and refunds. Read the Taxpayer Bill of Rights

... Continue Reading2019 YEAR END TAX STRATEGIES

General Tax Planning Moves Higher income filers ($250,000 married filing joint; $125,000 single) may be subject to the additional 3.8% Net Investment Income Tax. This is based on the calculated amount of the Adjusted Gross Income. There is also the additional 0.9% Medicare tax on these high-income

... Continue Reading401(k) contribution limit increases to $19,500 for 2020; catch-up limit rises to $6,500

WASHINGTON — The Internal Revenue Service today announced that employees in 401(k) plans will be able to contribute up to $19,500 next year. The IRS announced this and other changes in Notice 2019-59 (PDF), posted today on IRS.gov. This guidance provides cost‑of‑living adjustments affecting dollar

... Continue ReadingIRS provides tax inflation adjustments for tax year 2020

WASHINGTON — The Internal Revenue Service today announced the tax year 2020 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes. Revenue Procedure 2019-44 (PDF) provides details about these annual adjustments. The tax law change

... Continue ReadingSOCIAL SECURITY AMOUNTS FOR 2020

The Social Security Administration has announced the new amounts for 2020. The gross Social Security benefits are increasing 1.6% for 2020. Some of the other limits change by different percentages. Here is the information for 2020 (followed by 2019 amounts): The amount of earnings

... Continue Reading